[ad_1]

With simply days left earlier than a spot Bitcoin ETF is anticipated to be permitted by the US Securities and Alternate Fee (SEC), Alistair Milne, Chief Funding Officer (CIO) of Altana Digital Forex Fund, addressed a number of myths surrounding the Spot Bitcoin Alternate-Traded Funds (ETFs). In current weeks and months, a number of shockingly false rumors have continued, portray a false image of the long run with a spot ETF.

Busting Myths: A Look At The Most Stunning Rumors

Milne emphasised the stringent authorized and operational frameworks governing spot ETFs. With this, he addressed the widespread delusion that spot ETF may water down the 21 million provide of BTC by injecting “paper Bitcoin”. He said, “Spot ETFs are legally obliged to take a position internet inflows in BTC, which will probably be held by a custodian, absolutely audited, and so on.”

Furthermore, ETF suppliers like BlackRock, Constancy and Bitwise are ‘seeding’ their ETFs with money on exchanges to be prepared to purchase Bitcoin when inflows happen. It is a proactive measure to handle liquidity and keep the ETF’s efficiency according to Bitcoin’s market actions – – however once more, no manipulation is going down.

Additionally, the spot ETFs actions are dictated by inflows and outflows, not by discretionary choices of the fund managers like BlackRock’s Larry Fink. This implies the shopping for and promoting of Bitcoin by the ETF are purely transactional, primarily based on the fund’s have to steadiness inflows and outflows. “ETF suppliers don’t have any discretion as regards to shopping for or not shopping for, solely inflows/outflows might dictate their buying and selling,” Milne clarified.

In the identical vein, not like by-product ETFs, spot Bitcoin ETFs contain precise BTC, which underscores their direct hyperlink to the cryptocurrency’s market dynamics. “Bitcoin spot ETFs will dramatically improve the proportion of spot BTC traded vs by-product (unbacked) volumes … lowering the affect of the latter BTC’s value will probably be tougher to suppress, not simpler,” Milne defined.

ETF That Underperforms Bitcoin Will Go Out Of Enterprise

Market Makers (MMs) and others will commerce or arbitrage the ETF’s inventory versus spot Bitcoin. That is performed to make sure that the ETF is priced as near the precise market worth of BTC as attainable, thereby exploiting any inefficiencies for revenue. Milne additional elaborated {that a} spot ETF that underperforms Bitcoin (earlier than charges) will probably exit of enterprise, as its worth is anticipated to reflect that of Bitcoin’s market efficiency.

The dialogue on X additionally ventured into the dynamics of investor motion between completely different ETF suppliers. In response to a question about potential shifts from Grayscale Bitcoin Belief (GBTC) to different ETFs, Milne clarified, “GBTC will immediately be at par worth, so the one sellers are probably those that purchased at a reduction and wish to rotate again to self-custody (like me). Web impact after 1-2 working days can be zero. Somebody promoting GBTC and shopping for, for instance, IBTC the identical hour shouldn’t have any impact both.”

One other delusion revolves across the trustworthiness of ETFs. A consumer expressed skepticism about reliance on conventional auditing strategies, suggesting that on-chain signed messages from the custodians can be the one dependable proof to stop fraud like FTX.

Milne countered this by highlighting that “BTC holdings should be attested to by their custodians and likewise audited by companies much more respected and educated than FTXs. For instance, they may require they show management of the keys for all addresses.”

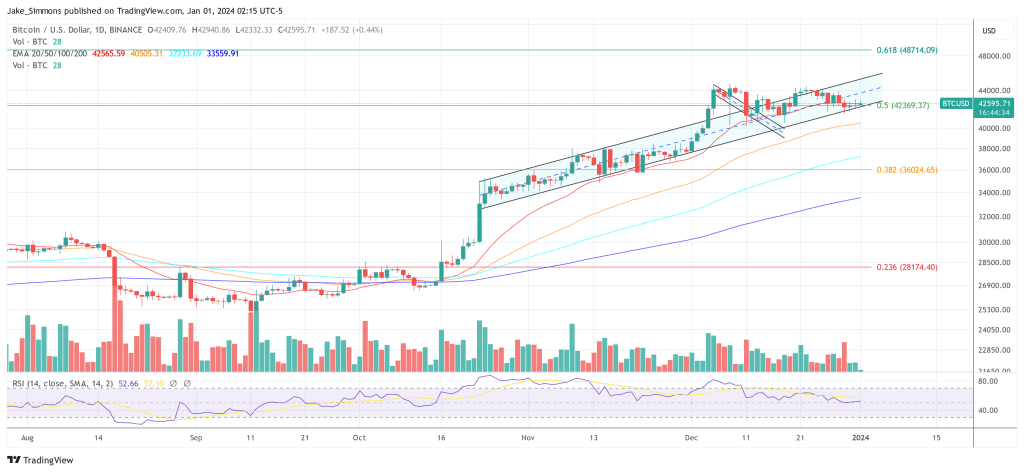

At press time, the BTC value traded at $42,595.

Featured picture created by DALL·E 3, chart from TradingView.com

[ad_2]

Source link