[ad_1]

Financial institution of England governor Andrew Bailey has stated rate of interest cuts may quickly develop into “extra aggressive”, sparking a drop within the worth of the pound.

Mr Bailey stated the Financial institution could possibly develop into “extra activist” in its method to borrowing prices if latest constructive inflation traits maintain.

The feedback mark a departure from his earlier method, when he stated charges would solely be lowered progressively. Shortly after his feedback immediately, the pound fell by practically one per cent in opposition to the greenback and the euro.

The Financial institution reduce charges from 5 per cent to five.25 in August, the primary discount since March 2020, after inflation returned to the two per cent goal. Though the determine has since risen again as much as 2.2 per cent, specialists have been forecasting one other rate of interest discount earlier than the tip of the 12 months.

The Financial institution is predicted to chop charges subsequent month by one other quarter proportion level to 4.75 per cent, however Kathleen Brooks, analysis director at XTB, stated that in mild of Mr Bailey’s feedback, monetary markets additionally now see a 61 per cent probability of one other discount in December.

“The market has used Mr Bailey’s feedback as a inexperienced mild to cost in additional financial loosening,” she stated.

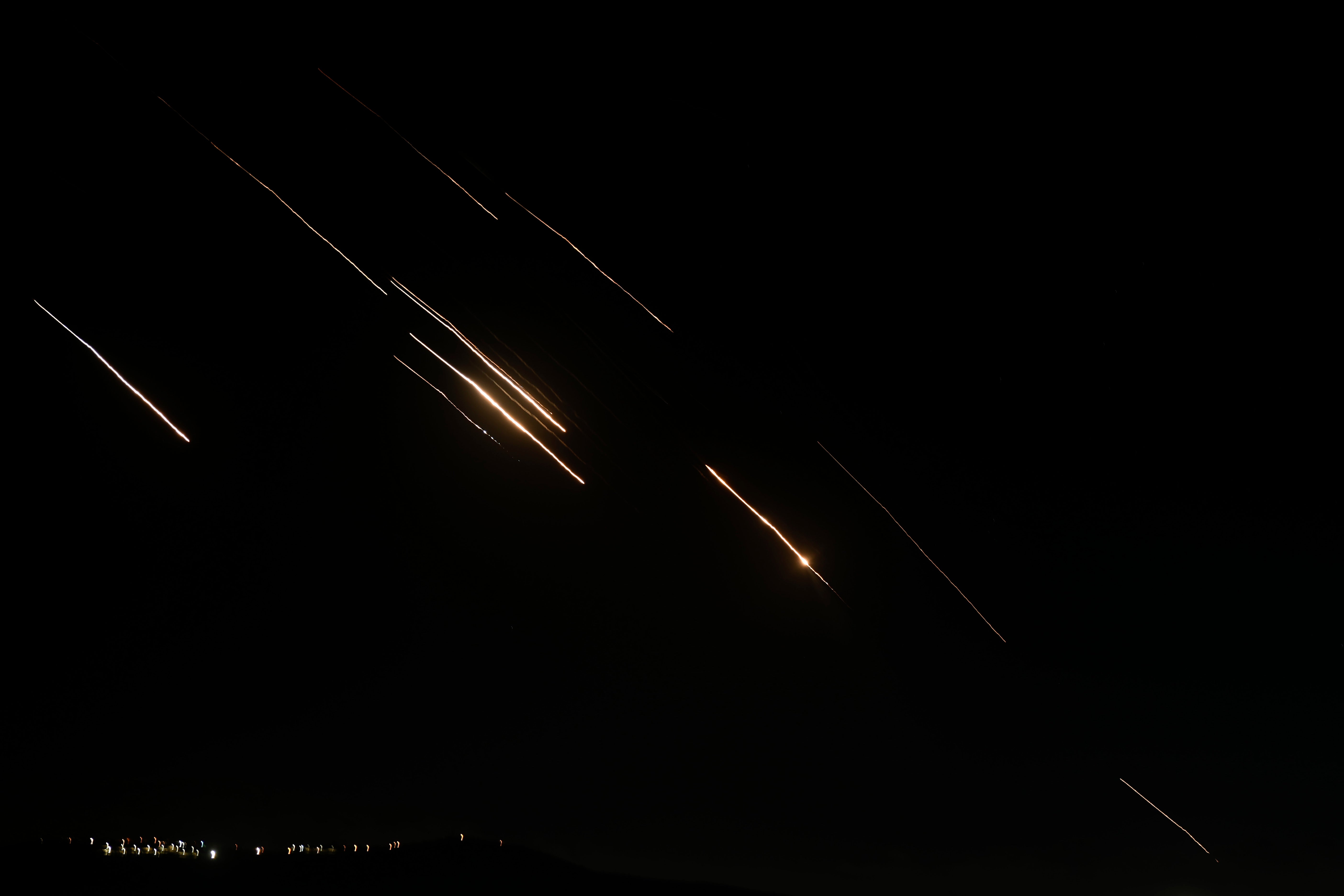

Mr Bailey additionally stated that the Financial institution is monitoring developments within the Center East “extraordinarily intently” amid steep rises in the price of oil, which surged this week after the Israeli invasion of southern Lebanon and Iran’s missile assault on Israel.

He stated: “Geopolitical issues are very severe,” including: “It’s tragic what’s happening.

“There are clearly stresses and the actual situation then is how they may work together with some nonetheless fairly stretched markets in locations.”

A report from the Financial institution’s Monetary Coverage Committee (FPC) on 2 October warned that international monetary markets are susceptible to shocks following a “spike in volatility” over the summer time amid uncertainty over the geopolitical scenario worldwide.

However Mr Bailey stated oil costs haven’t seen the eye-watering will increase of the previous within the 12 months because the Hamas assault on Israel.

He stated: “From the viewpoint of financial coverage, it’s an enormous assist we haven’t needed to cope with an enormous improve within the oil value.

“However clearly we’ve had that have previously, and within the Nineteen Seventies the oil value was an enormous a part of the story.

“Clearly we maintain watching it. We watch it extraordinarily intently to see the affect of the newest information.”

He warned that, whereas markets stay secure, “there’s additionally recognition there’s a degree past which that management may break down if issues bought actually unhealthy”.

[ad_2]

Source link