[ad_1]

2023 began with a difficult general panorama for the crypto market that continued all through the remainder of the 12 months. Nonetheless, the market noticed a restoration with a spike in bullish sentiment and ended the 12 months on a optimistic word.

Moreover, 2023 noticed a decline in crypto scamming and crypto-related illicit exercise in comparison with the earlier 12 months, as new information exhibits.

Illicit Exercise Market Income Decline In 2023

American blockchain evaluation agency Chainalysis launched its 2024 Crypto Crime Report detailing the traits and figures that crypto-related illicit actions noticed in 2023. The agency’s information exhibits a major drop in worth obtained in cryptocurrency addresses used for illicit actions, totaling $24.2 billion.

This can be a appreciable discount in comparison with the 2022 up to date estimate of $39.6 billion. As well as, the share of all crypto transaction quantity related to illicit exercise diminished from 0.42% in 2022 to 0.34% in 2023.

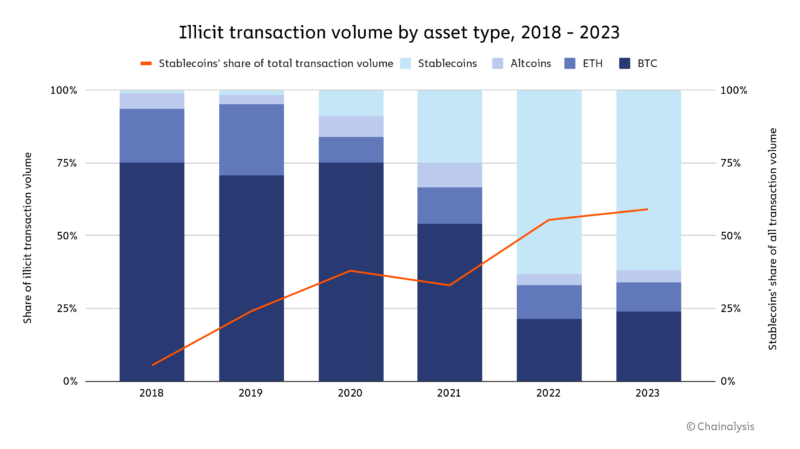

In keeping with the report, there appears to be a shift in the kind of property concerned in crypto-related crime actions during the last two years, with Bitcoin not being essentially the most used asset for many illicit transactions.

Alternately, stablecoins have turn out to be a extra fashionable alternative for crypto property concerned in illicit actions, because the report states. This enhance may very well be attributed to the latest common progress of stablecoins’ share of all crypto exercise general.

The shift to stablecoins just isn’t seen in each associated crime, with actions, reminiscent of darknet market gross sales and ransomware extortion, nonetheless going down predominately in Bitcoin.

Nonetheless, it’s price noting that their issuers can hint stablecoins, and funds will be frozen when addresses are linked to illicit actions, as Tether did again in 2023.

Illicit transaction quantity by asset sort, 2018-2023. Supply: Chainalysis

Developments That Outlined Crypto-Associated Crime In 2023

Chainalysis on-chain metrics counsel that scamming revenues have been trending globally since 2021. Though these crimes are nonetheless underreported, “general, scamming is down, given broader market dynamics.”

Romance scams, reminiscent of ‘pig butchering,’ are among the many hottest crypto scamming techniques utilized by scammers and are one of many largest types of associated crime by transaction quantity.

Concerning crypto hacking, the agency believes that “the decline in stolen funds is pushed largely by a pointy dropoff in DeFi hacking,” it may symbolize “the reversal of a disturbing, long-term development.” In 2023, crypto scamming and hacking income fell considerably, with the full income reducing 29.2% and 54.3%, respectively.

In distinction to the general traits, ransomware and darknet markets, two of essentially the most outstanding types of associated crime, noticed revenues rise in 2023. Equally, 2023’s progress in darknet market income comes after a 2022 decline in income.

The report exhibits that transactions with sanctioned-related entities and jurisdictions drive many of the illicit exercise as entities and jurisdictions transfer in the direction of utilizing stablecoins and different crypto property to bypass restrictions.

They accounted for a mixed $14.9 billion transaction quantity in 2023, representing 61.5% of all illicit transactions over the 12 months. Chainalysis explains that:

Most of this whole is pushed by cryptocurrency providers that had been sanctioned by the U.S. Division of the Treasury’s Workplace of International Property Management (OFAC), or are situated in sanctioned jurisdictions, and might proceed to function as a result of they’re in jurisdictions the place U.S. sanctions aren’t enforced.

Finally, the report addresses that not all sanction-related transactions are as a result of illicit use of digital property, as a few of that $14.9 billion quantity is expounded to the common customers who reside within the sanctioned jurisdictions.

Bitcoin buying and selling at $41,906.6 on the hourly chart. Supply BTCUSDT on TradingView.com

Featured picture from Unsplash.com, Chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site fully at your personal threat.

[ad_2]

Source link