[ad_1]

Cardano (ADA) has just lately emerged as a focus of investor consideration, experiencing each a surge in inflows and mounting issues over its efficiency. In accordance with the newest information from CoinShares, Cardano-centric funding merchandise witnessed a staggering $1.1 million inflow over the previous week, marking a notable reversal from the $3.7 million outflows recorded only a week prior.

Cardano Sees Huge Inflows

This sudden inflow catapults Cardano to the forefront of investor curiosity in comparable merchandise, reflecting a rising prominence for the cryptocurrency inside the crypto funding panorama. Regardless of experiencing a discount in positions in March, recent information suggests a constructive trajectory for Cardano by the tip of the month, hinting at resilience amidst market fluctuations.

A restoration for Bitcoin ETFs, with US$862m inflows final week pic.twitter.com/D1OWUSdGIU

— James Butterfill (@jbutterfill) April 1, 2024

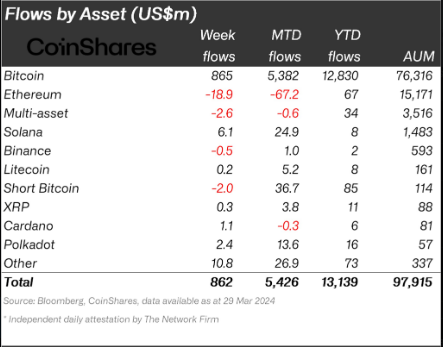

The resurgence of investor curiosity in Bitcoin ETFs has additionally contributed to a broader enhance in crypto funding exercise, with complete crypto funding inflows for the reason that starting of the yr surpassing $13 billion. Bitcoin ETFs absorbed nearly all of these inflows, totaling $12 billion, indicating strong investor confidence within the main cryptocurrency.

Supply: Coinshares

Supply: Coinshares

Amidst these developments, hypothesis looms relating to the potential for a Cardano ETF. Whereas Cardano’s capacity to draw funding amid a aggressive market panorama underscores its rising prominence, the prospect of a Cardano ETF stays speculative, notably given the continuing state of affairs with Ethereum.

Nevertheless, as capital continues to stream into ADA-oriented funding merchandise, Cardano’s place on the monetary markets is more likely to strengthen, positioning it as a notable contender within the ongoing crypto ETF increase.

ADA market cap at the moment at $21 billion. Chart: TradingView.com

ADA Tells A Totally different Narrative

Regardless of the constructive inflows, issues linger over Cardano’s current efficiency in comparison with different property. ADA has seen sluggish efficiency, with losses of three.50% and solely 6.40% features year-to-date, in response to CoinMarketCap.

Evaluation reveals a drop within the proportion of ADA’s complete provide in revenue, from 80% to 75%, indicating a development of promoting exercise and elevating issues about ADA’s trajectory amidst bullish market tendencies.

Moreover, there’s a notable lower within the variety of wallets holding substantial quantities of ADA, signaling a shift in investor habits. This lower may probably replicate a insecurity in ADA’s future prospects or a need amongst buyers to reallocate their property to different cryptocurrencies or funding automobiles.

The juxtaposition of elevated investor curiosity and issues over efficiency paints a nuanced image of Cardano’s present standing within the cryptocurrency market. Whereas the surge in inflows highlights rising investor confidence and recognition of Cardano’s potential, the challenges posed by sluggish efficiency and shifting investor sentiments underscore the necessity for vigilance amongst ADA buyers.

Featured picture from Jeremy Bishop/Unsplash, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site solely at your individual danger.

[ad_2]

Source link