[ad_1]

Over the previous decade, Coinbase has reached thousands and thousands of cryptocurrency merchants and expanded to change into the most important crypto trade within the US. Regardless of its stable repute, Coinbase didn’t avert scrutiny and skepticism. It has intensified prior to now two years, pushed by the sharp upsurge and plunge in crypto costs in a brief interval. However what has change into the recent subject was the sudden collapse of FTX, the previous largest crypto trade worldwide.

Nonetheless, it stays an influential determine out there. True believers regard cryptocurrencies regardless of not being a positive inflation hedge. Bitcoin’s inverse correlation with inflation confirmed how a lot macroeconomic indicators may have an effect on crypto costs. Merchants proceed to capitalize on crypto volatility to generate huge beneficial properties.

Given this, Coinbase enjoys excessive crypto balances. This formidable crypto trade big leverages the weak point of its smaller friends. Inflows and outflows could generally be overwhelming, however its liquidity ensures it will probably maintain its operations. Therefore, this text will clarify why Coinbase is a secure cryptocurrency trade.

What Makes Coinbase a Protected and Liquid Cryptocurrency Trade

As a crypto buying and selling beginner, one usually seems to be for these exchanges with low transaction charges and safe consumer anonymity. However a extra necessary consideration is whether or not it will probably maintain enterprise operations with huge transactions.

Being within the enterprise for over a decade, we could not need to ask ourselves, “Is Coinbase secure?” It has undergone huge ups and downs, such because the crypto bubble burst in 2017-2018 and the FTX fallout in 2022. Its liquidity and sensible token allocation make it probably the most sturdy crypto exchanges. These are some causes Coinbase is a secure crypto trade.

Steady month-to-month market share

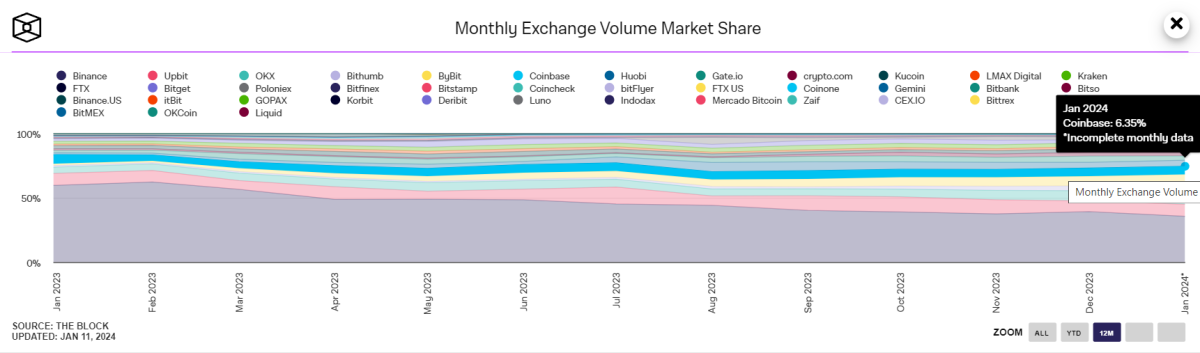

Because the FTX collapse, we have now seen how Binance has swiftly taken over the market. It dethroned Coinbase and saved a large margin from its friends for a very long time.

Even so, Coinbase confirmed it has not but faltered and wouldn’t be one other FTX regardless of the large drop in merchants’ confidence. Binance would be the big now, however Coinbase is among the unique crypto exchanges. It has stood the take a look at of time, going through huge crypto market shocks in recent times.

However what makes it a memorable crypto trade contender is its steady market share. In January 2023, its market share was 6.97%. It plunged to 4.58% in solely a month, the bottom market share in a few years.

It rebounded within the following months however stayed inside a 5-6% vary. However for the reason that second half of 2023, we will see a sustained enhance in its market share earlier than climbing to six.2%. There have been some ups and downs, however they had been far more manageable than in 2022.

On the finish of the yr, the market share elevated once more to six.34%. As of at the moment, it’s recorded at 6.35%. It could be decrease year-over-year however a lot better than within the earlier months. The sustained rebound exhibits it will probably stand up to challenges and regain momentum amid tight competitors. It’s certainly a resilient crypto trade.

And if we evaluate it to different exchanges, Coinbase had probably the most steady market share adjustments prior to now yr. Take Binance for example. It stays the most important trade however has already misplaced about 25% of its market share after falling from 59% in January 2023 to 35% at the moment.

We are able to attribute it to the current controversy the place it admitted its fault for violating the US Anti-Cash Laundering Act. Therefore, its shut rivals, equivalent to Coinbase, OKX, and Upbeat, capitalize on it to generate extra merchants.

Excessive cryptocurrency steadiness

One other issue to contemplate is the liquidity and availability of digital belongings. Given its ample steadiness of main cryptocurrencies, Coinbase stays an enormous cryptocurrency trade. These embrace Bitcoin (BTC) and Ethereum (ETH).

Coinbase is the second-largest cryptocurrency trade within the complete Bitcoin steadiness. As of this writing, it has 411,762.68 Bitcoins or 2.2% of the whole circulating provide out there. It additionally has a slim hole with Binance, the highest Bitcoin holder, with 554,836.88 or 2.8% of the whole market quantity.

Bitfinex comes as a detailed third with 388,742.04 or 2.0% of the whole market provide. The highest three Bitcoin exchanges have a large margin from the fourth placer, OKX, with simply 132,678.97 or 0.7%.

With regard to Ethereum, the whole steadiness in Coinbase is 2,185,579.12, or 1.8% of the whole circulating provide. It ranks third after Binance and Bitfinex with 3,770,920.82 or 3.1% and a couple of,349,649.56 or 2.0%, respectively. Kraken is in fourth place with 1,691,412.27, or 1.4% of the whole circulating cash. These 4 largest Ethereum holders are far bigger than OKX, the fifth placer with 945,955.80 or 0.8%.

Even in different cryptocurrencies, Coinbase additionally has one of many largest reserves. It ranks second in USDC with 516,852,821.09, though it’s far decrease than Binance with 1,454,578,122.56. It has a large distinction from OKX, the third placer, with 157,577,919.60. The remaining exchanges with USDC have lower than a 100,000,000 steadiness.

For smaller cryptocurrencies, Coinbase stays widespread because it is among the prime ten holders of their reserves. A number of examples embrace DAI (fifth- 2,848,007.58), USDT (ninth- 35,157,653.02), SKL (seventh- 7,393,205.74), and USDP (fourth- 482,327.81).

Given this, Coinbase seems to have ample liquidity ranges, permitting it to maintain high-volume transactions. It is a essential side to contemplate in a extremely risky market.

Prudent Token Allocation

Merchants must also think about the extent of reliance on a particular token or coin. The previous largest crypto trade, FTX, could have uncared for this important side. Its reliance by itself tokens led to its sudden downfall in 2022. This led to capital outflows in lots of different exchanges, and Coinbase was no exception.

On a lighter observe, Coinbase doesn’t seem like one other FTX within the making, given its excessive steadiness of assorted cryptocurrencies. It isn’t closely reliant on a single cryptocurrency. It holds numerous cryptocurrencies and is a part of the highest ten exchanges in lots of cryptocurrencies it holds.

Like most crypto exchanges, Bitcoin stays its most plentiful reserve. It’s a essential token since many companies around the globe broadly settle for it. Ethereum comes second, additionally used for enterprise and authorities transactions. Many authorities companies are taking Ethereum contracts for his or her providers.

These two cryptocurrencies are important in numerous states, particularly Texas, which has the ninth-largest financial system globally. That’s the reason following the necessities and processes of forming an LLC in Texas is less complicated with crypto funds.

As such, Coinbase can stand up to a large outflow of a single cryptocurrency. Fortunately, its excessive liquidity will assist it cowl the foregone capital whereas refocusing on different reserves.

Key Takeaways

Coinbase has been by means of crests and troughs since its inception a decade in the past. Though it has a protracted strategy to go earlier than it goes head-to-head with Binance, it has an enormous potential to outperform the third and second placers. Its existence for over ten years says quite a bit about its resilience and prudence. Therefore, this crypto trade guarantees security to cryptocurrency merchants.

It is a visitor submit by Ivan Serrano. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link