[ad_1]

The newest UK client worth index (CPI) information has been hailed as a win for prime minister Rishi Sunak’s goal to half inflation, introduced earlier this yr. Costs rose by 4.6% in October 2023, bringing the speed of worth development right down to its lowest level since an October 2022 peak of 11.1%.

However inflation coming down steadily doesn’t imply costs are falling – they’re merely growing at a slower tempo. Costs stay excessive, deepening the price of residing disaster for a lot of, particularly these whose nominal wages haven’t elevated at tempo with inflation in recent times.

Compounding this, poor households spend a much bigger proportion of their revenue on meals, power, and hire – three prices which have spiked essentially the most in recent times, and nonetheless stay excessive.

A decline in power costs was the most important contributor to the current inflation slowdown. However although electrical energy, gasoline and different gasoline prices have fallen by 21.7% since October 2022, these costs stay very excessive.

Gasoline costs are about 60% increased than they have been in October 2021 and the value of electrical energy is about 40% increased. In comparison with January 2021, electrical energy, gasoline and different gasoline prices are at the moment 82% increased.

Annual inflation within the worth of meals and non-alcoholic drinks can also be nonetheless excessive at 10.1%. October 2023 meals costs have been round 30% increased than in October 2021, whereas personal rents are up by 11.5% in comparison with January 2021.

The federal government’s fears of a wage-price spiral – its reasoning for holding out in opposition to public sector strikes for therefore lengthy – have additionally did not materialise.

An ample enhance in public sector pay in well being, training and the civil service would have reversed many years of below-inflation pay for these employees. And public sector wages don’t straight result in rising enter prices for personal corporations, and so would have executed little to gasoline a wage-price spiral.

Learn extra:

Strikes: why refusing public sector pay rises will not assist cut back inflation

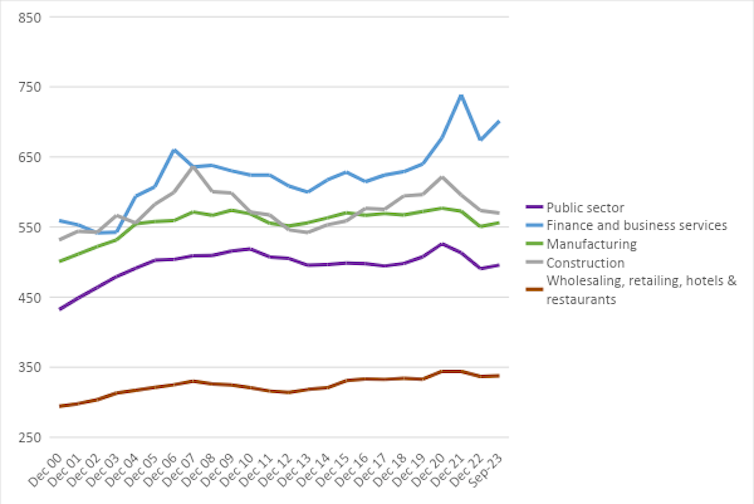

Current wage disputes and excessive job emptiness charges have delivered solely modest will increase in actual pay within the public sector (1.4%). Wages have stagnated in manufacturing and wholesaling, retailing, inns and eating places sectors, and fallen in development (by 2.8%) as of September 2023 in comparison with September 2022.

The one sectors that noticed a considerable actual pay rise are finance and enterprise companies (2%) and transport and storage (15.8%). The truth is, actual wages stay under pre-pandemic ranges in all different sectors.

Wages are stagnant or falling in some sectors:

Writer supplied utilizing Workplace for Nationwide Statistics information., CC BY-NC-ND

Boosting income

In the meantime, some companies have added the rising prices of inputs like power and meals into the value of the products they promote, squeezing the poorly-paid from the opposite aspect. Some have even elevated their revenue margins since 2021 by elevating costs at a sooner price than the rise of their enter prices.

A Financial institution of England survey reveals most of the companies with the best revenue margins are anticipated to extend their revenue margins additional in 2023, whereas companies with the bottom revenue margins reported a drop in 2022, and are solely anticipated to see a partial restoration this yr.

Wages might enhance with out inflicting increased inflation if the highest companies reduce their revenue margins. This is able to additionally assist the companies who weren’t in a position to go on excessive enter, wages or borrowing prices to their prospects. With firm insolvencies at a 14-year excessive, they’re as a substitute reducing again non-essential spending.

However the authorities has executed little to deal with the rise in revenue margins for the highest corporations past a restricted power worth cap and windfall taxes on power corporations. As meals costs soared, authorities intervention amounted to conferences with the farmers, meals producers and a few of Britain’s largest supermarkets to debate capping worth will increase in 2023 with out precise worth controls.

Learn extra:

Six methods the upcoming autumn assertion might have an effect on your private funds

Chancellor Jeremy Hunt’s upcoming autumn assertion is unlikely to supply many stable options to sort out the price of residing disaster or issues with public bodily and social infrastructure. Hunt is anticipated to stay to the narrative {that a} discount in public debt/GDP is crucial to battle inflation.

Equally, the Financial institution of England might maintain rates of interest once more at its subsequent Financial Coverage Committee assembly in December, regardless of stagnation in client demand and enterprise funding.

These insurance policies won’t assist to deal with the a number of intersecting crises dealing with the UK proper now, together with inequalities at school, gender and race, ecological breakdown, geopolitical turmoil and technological change – to not point out the continuing price of residing disaster.

[ad_2]

Source link