[ad_1]

As anticipation builds across the potential approval of the primary spot Bitcoin ETFs within the US by the Securities and Alternate Fee, the key phrase “XRP ETF” is at present trending on X (previously Twitter). Quite a few XRP group members have posted supposed proof that an ETF within the US is on its approach and will quickly change into a actuality. Nevertheless, a more in-depth examination reveals a extra nuanced actuality.

Why is $XRP ETF trending? 👀

— XRPcryptowolf (@XRPcryptowolf) January 7, 2024

XRP ETF Is Trending

Good Morning Crypto just lately said, “JUST IN: Constancy Unveils XRP ETP !?! With Grayscale & Constancy providing XRP merchandise, 2024 may very well be the breakout 12 months for XRP because it inches nearer to all-time highs.” Equally, XRP CAPTAIN introduced, “BREAKING: Spot XRP ETF is for actual,” whereas CryptoGeek claimed, “BREAKING: XRP ETF CITED TO BE RELEASED IN A ‘MATTER OF WEEKS’ FOLLOWING BITCOIN ETF APPROVAL BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION.”

BREAKING 🚨🚨 SPOT #XRP ETF Is For Actual 💥💥🚀🚀🚀 pic.twitter.com/Up2sA9jbDK

— XRP CAPTAIN (@UniverseTwenty) January 7, 2024

The foundation of those claims lies in an XRP ETP from 21Shares (previously Amun), which is accessible on Constancy Investments’ platform. This growth has generated vital pleasure inside the XRP group. Nevertheless, the narrative round a US-launched ETF is deceptive.

The thrill partly stems from Grayscale’s current determination to reincorporate XRP into its Grayscale Digital Giant Cap (GDLC) fund, following Choose Analisa Torres’ July 2023 ruling that categorized XRP as a non-security. This ruling reversed Grayscale’s earlier elimination of XRP in January 2020 amid authorized controversies over its safety standing. This transfer by Grayscale has fueled hypothesis about an upcoming ETF from the agency.

However opposite to circulating claims, Constancy has not launched an XRP ETP. Constancy’s platform solely showcases the XRP ETP launched by Swiss monetary establishment Amun AG in April 2019. This product, initially referred to as AXRP and later rebranded to 21Shares, is accessible on the SIX Swiss Alternate. Furthermore, it isn’t a US-registered ETP.

In the meantime, it’s backed by bodily XRP and managed by Coinbase Custody. Remarkably, the product is 100% backed by bodily XRP and information $49,325 million in property underneath administration (AUM).

Why A XRP ETF Received’t Occur Anytime Quickly

Relating to the potential for an XRP ETF within the US, Bloomberg ETF skilled James Seyffart provided a sobering perspective a number of months again in response to rumors a couple of pretend BlackRock XRP ETF which initiated a 15% pump that was shortly erased. In an interview, he said: “I don’t assume that XRP is ever going to get by means of the SEC’s doorways, primarily not anytime quickly, even after that loss [Ripple vs. SEC].

He added, “Initially, CME must record XRP futures earlier than a futures ETF would launch, and I can’t think about them permitting them a spot XRP ETF anytime quickly. However once more, like I mentioned, three weeks in the past I mentioned I didn’t assume Ethereum futures ETFs can be coming anytime quickly except there’s an enormous change within the SEC, so theoretically it may very well be. However the SEC has mentioned in that Terra case and a number of different instances that they imagine Choose Torres received it flawed.”

In abstract, whereas the XRP group’s pleasure is palpable, the fact of an ETF within the US stays distant, with regulatory hurdles and the SEC’s stance posing vital challenges.

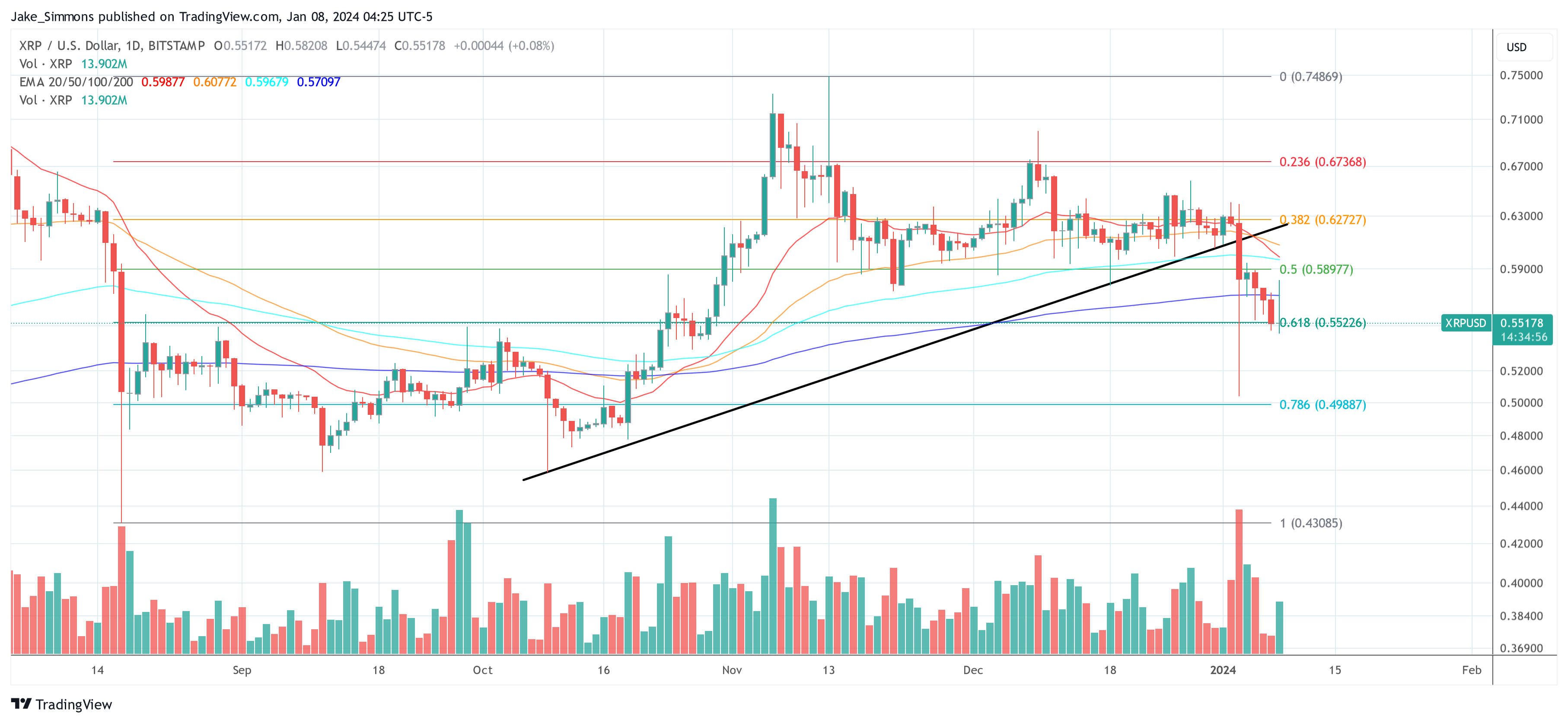

At press time, XRP traded at $0.55178.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site fully at your individual danger.

[ad_2]

Source link